student loan debt relief tax credit application for maryland resident

August 24 2022 On Aug. 1 day agoThose borrowers will have to log into StudentAidgov with their Federal Student Aid ID and upload a copy of their tax returns or proof they didnt have to file taxes according to.

Tax Credit 2022 Deadline For Maryland Residents To Claim 1 000 Student Loan Debt Relief Credit Is 18 Days Away Washington Examiner

Complete transcripts from each undergraduate.

. To qualify applicants must. The Oregon Department of Justice said the scams have hooks like Pre-enrollment for all loan forgiveness or urgent calls to action. T he deadline for Maryland residents to claim a Student Loan Debt Relief Tax Credit of up to 1000 is coming up in just over two weeks.

Only Washington DC. The following documents are required to be included with your completed Student Loan Debt Relief Tax Credit Application. 15 to submit an application for Tax Year 2022.

23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan Debt Relief Tax Credit by Sept. To apply for the. The applicants must also prove they used the full amount of the tax credit to pay down their student loans.

Eligible people have 16 days to. 15 deadline no longer shows up at the FAQ site for One-Time Student Loan Debt Relief. In forgiven federal student loans.

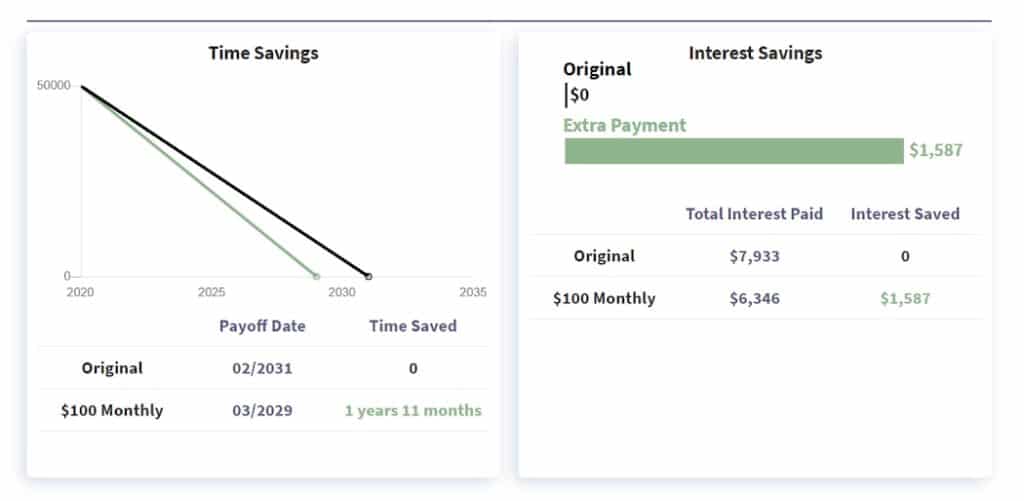

You must apply within the next 24 hours. To apply for the credit the first important thing to note is the deadline is coming fastSeptember 15 but the application can be done online so theres still time. The deadline to apply is September 15th.

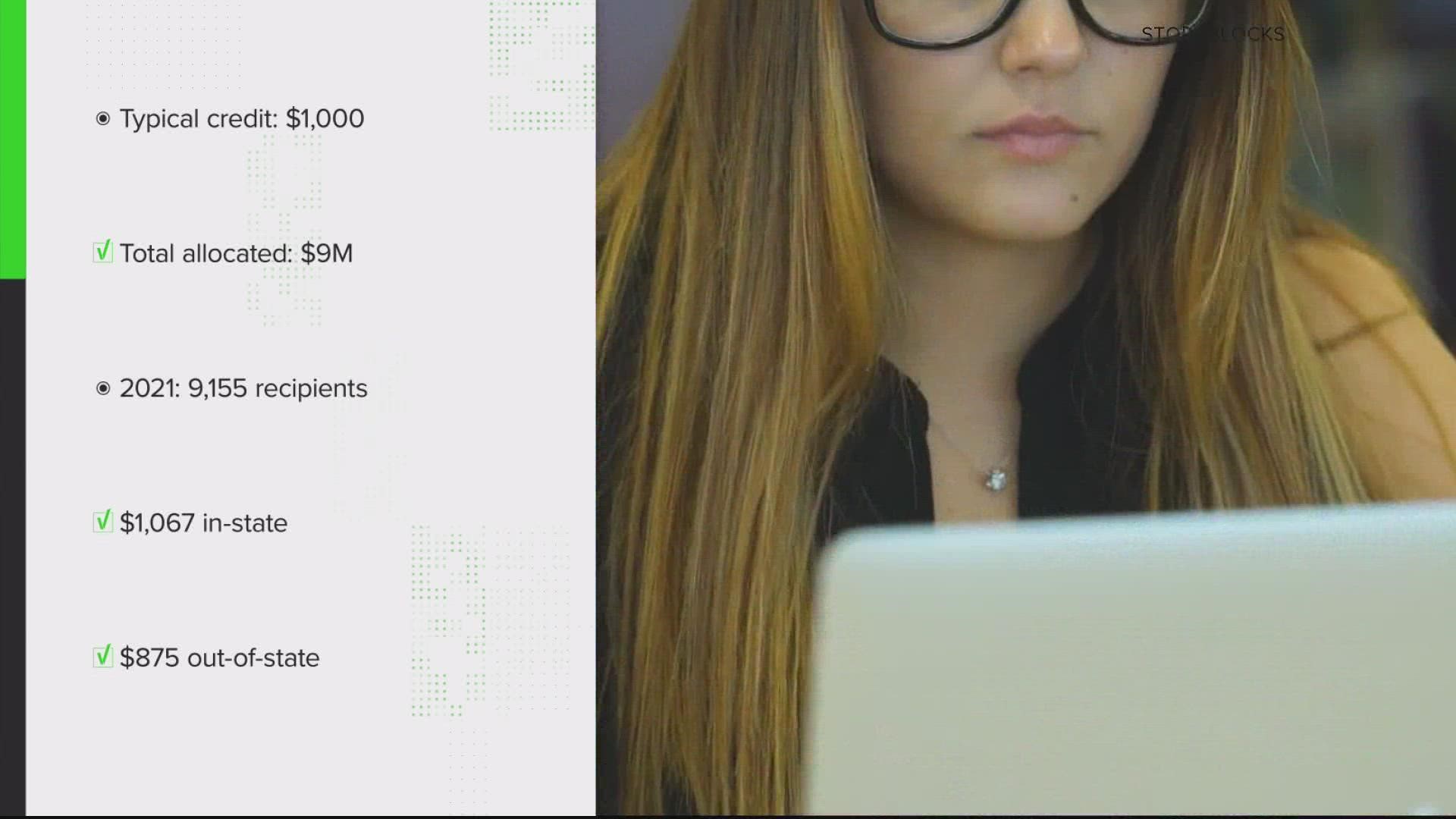

Those who attended in-state institutions received 1067 in tax credits while eligible applicants who attended out-of-state institutions received 875 in tax credits. Has an average loan balance per borrower higher than Maryland. Eligible people have until Sept.

Minimum income requirementsDoes not discloseMinimum credit score650Prepayment penaltyNoneCosigner releaseAvailable for in-school private loans not for. The county tax for Marion for example. The state is offering up to 1000 in.

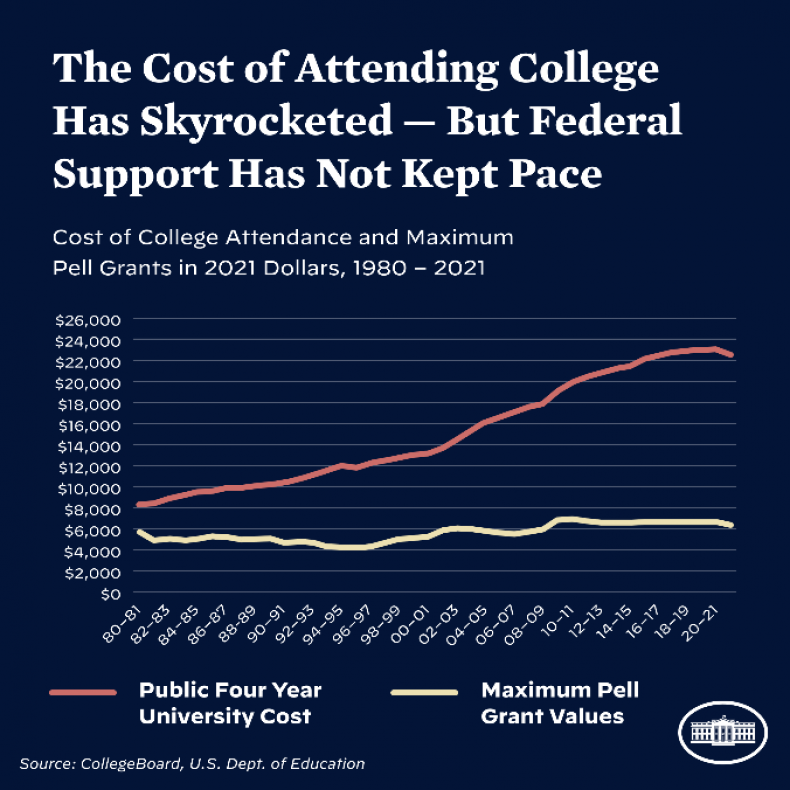

The credits goal is to aid residents of the Chesapeake Bay state who took out college. 082522 Since 2017 Marylands student loan debt relief tax credit has provided over 40 million to over. 15 to apply for a Student Loan Debt Relief Tax Credit of up to 1000.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt. September 14 2022 757 pm. 6 minutes agoThe Biden administration has just given us our first peek at the federal student loan forgiveness portal complete with everything youll need to claim up to 20K in debt relief.

But the state offers a Loan Debt Relief Tax Credit for borrowers who took out at. Department of Education has announced a student debt relief plan to cancel thousands of dollars in federal student debt for every single borrower who meets the. Marylanders are eligible if they file their taxes have incurred at least 20000 in student.

1 day agoBut the Nov. If you live in Maryland you have only days left to apply for a tax credit to cover some of your student loans. Residents have until Thursday Sept.

How to apply for Marylands student loan debt relief tax credit Posted.

Marylanders In Need Urged To Apply For Student Loan Debt Relief Tax Credit Wbal Newsradio 1090 Fm 101 5

Taxes Refund 2022 Student Loans Tiktok Search

Application Process Opens For Student Loan Debt Relief Tax Credit

Student Stimulus Check From Maryland Deadline Looms For Student Loan Debt Relief Tax Credit Valuewalk

Student Loan Forgiveness Updates Next Steps For Qualifying Borrowers

Studentloandebt Explore Facebook

Governors Leading On Supporting Student Loan Borrowers National Governors Association

Learn How The Student Loan Interest Deduction Works

Maryland Student Loan Debt Relief Tax Credit R Maryland

Howard County Executive Calvin Ball Do You Have Student Loans Maryland Taxpayers Who Have Incurred At Least 20 000 In Undergraduate And Or Graduate Student Loan Debt And Have At Least 5 000 In

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 More Than 40 000 Students Graduates Have Received Credit Since 2017 The Baltimore Times Online Newspaper Baltimore News

Tax Credit 2022 Deadline For Maryland Residents To Claim 1 000 Student Loan Relief 12 Days Away Washington Examiner

Maryland Student Loan Tax Credit Tiktok Search

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

Over 6 Million In Debt Relief For Past Itt Students From Maryland Who Were Defrauded By The School The Moco Show

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Southern Maryland Chronicle

Quick Guide Maryland Student Loan Debt Relief Tax Credit

Where To Find The Top Maryland Student Loan And Refinance Options Student Loan Planner

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com